ELECTRO MOBILITY MARTKET TREND

India’s economy is picking up post worldwide lock-down and growth prospects look bright partly thanks to the implementation of recent policies, such as the E-Invoice after nationwide goods and services tax. As one of the world’s fastest growing economies accounting for about 15% of global growth, India’s economy has helped to lift millions out of poverty.

Indian government has pushed various reforms / schemes over the last few years which include GST (Goods and service tax), Housing for All and IBC (Insolvency and Bankruptcy Code) among others. While it would take some time to realize the full benefits of these reforms. Near term benefits from “Housing for All” scheme (has a multiplier effect across value chain) and PSU bank recapitalization (will support credit growth) along with NPA resolutions are expected.

India corporate earnings had started normalizing after the demonetization / GST led Disruptions. Indian farmers protect against 3 farm acts which were passed by the Parliament of India in some states this will have a negative impact on the rural economy.

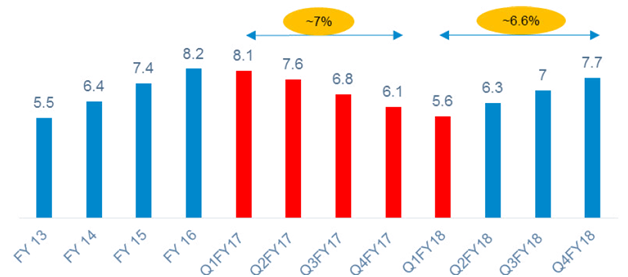

GDP grows to seven quarter high in Q4FY18 to 7.7% YoY vs 7% YoY growth seen in Q3FY18

Manufacturing has emerged as one of the high growth sectors in India. By 2020, the country was expected to become the fifth largest manufacturing destination, and is touted to hold potential to account for 25-30% of country’s GDP while creating up to 90 million jobs by 2025.

The Indian manufacturing industry has acknowledged the importance of Industry 4.0 and has now made it part of its long-term business strategy. Industrial companies in India are digitizing their essential functions with a focus on achieving operational efficiencies, cost control and revenue growth. Business transformation is underway as the manufacturing sector embarks on this digital journey.

The Indian government has already laid down a red carpet for manufacturing businesses – be it the start-ups or major corporations. It has backed its initiatives with positive moves towards streamlining policies that ensured consistency and removed various regulatory and bureaucratic hurdles of starting business in India. Government’s policy reforms like implementing GST and improving public spending through infrastructure projects are again favourable moves for the sector. Many manufacturing industry players have shown confidence in their companies achieving increased growth on the back of introduction of GST and an incessant push to infrastructure such as highways, etc.

At the same time, India’s skill ecosystem needs an overhaul. According to a FICCI report, India has 5.5 million people enrolled in vocational courses, while China has 90 million of them! The monumental difference clearly signifies a need to have a curriculum that focuses on soft-skills and value-based training that meets the demands of the industry.

Mobilizing and deploying a large pool of capital will be a key aspect of the manufacturing growth model. This will require a rapid expansion of the financial and banking system.

India being the dream manufacturer in every way is no distant dream.

Manufacturing sector seeing gradual revival in investment

Performance of the Index of Industrial Production (Base 2011-12)

Overview on Electric Vehicle Sector in India:

Back in 2011, the Indian Government approved the proposal to set up a National Mission for Electric Mobility (NCEM) to promote electric mobility and manufacturing of electric vehicles in India.

In 2013; the National Electric Mobility Mission Plan 2020 was launched for the promotion of hybrid and electric mobility in India, aimed at gradually ensuring a vehicle population of about 6–7 million electric/hybrid vehicles in India by 2020 along with a certain level of indigenisation of technology.

In 2015, the Government of India introduced the FAME India scheme [Faster Adoption and Manufacturing of (Hybrid &) Electric Vehicles in India], with the objective to support hybrid/electric vehicles’ market development and manufacturing eco-system. The scheme has four focus areas technology development, demand creation, pilot projects and charging infrastructure.

The Indian Government earlier flaunted an ambitious idea of having electric vehicles to account for 100% of all new sales by 2030, later only to come with a no need of a separate policy for EVs in India.

Charging infrastructure is one of the key concern areas for EVs. Recently, the government announced “charging of e-vehicles would be a service and not sale of electricity. Thus, all those setting up charging stations would not require a licence”.

The auto industry experts and related associations (SIAM) opine that the country should target 40% of personal vehicles and 100% of public transport vehicles to turn electric by 2030. It has suggested 2047 as the target for all-electric passenger vehicles.

Manufacturing Footprint of EVs in India

In India, the focus was on getting the public transport fleet onto the electrification journey before focusing on private vehicles. Priority will be given in the order of electric buses, 3 wheelers, fleet cars, 2 wheelers and then private cars.

To push this philosophy into action, the central government has started some key initiatives:

— DHI has come out with a scheme to assist all 1Mn+ populated cities to buy electric buseswith a subsidy support of ₹1.05 billion per city and ₹150 million for charging infrastructure).

— EESL, a Power Ministry PSU, having expertise in large aggregated procurements, has come out with a tender of 10,000 electric cars and about 4000 chargers and is on the verge of getting the first 500 e-cars delivered these cars will be used by government PSUs & ministries to meet their fleet cabs requirement.

— FAME scheme for 2Ws is a huge boost for the industry. Nearly 15–16 Indian firms operate in the 2W electric scooters and bikes segment, this is bound to move up faster.

— In 2017, the Government of India through extensive ministerial discussions came up with a major policy document in terms of “Transformative Mobility for All”. One of the key pillars of this transformative mobility is the emergence of EVs and the EV infrastructure that is likely to be needed.

Electric Vehicle Ecosystem in India

The Government of India is working towards an EV policy which is expected to be released in 2018 Q1. There are strong indicators from various policy makers in India to keep a focus on EVs and to look at other low carbon options such as Methanol and CNG. The government plans to work towards creating a demand for EVs by buying in bulk, which could provide large orders to automakers. Recently, a tender for 10,000 cars was issued and now a major tender for electric buses in 11 cities is likely to be released soon.

The Indian EV Industry is in its nascent stages with only two electric car manufacturers, about 10+ players in 2 wheelers and 3 – 4 OEMs in electric buses. Most other auto OEMs are now looking at introducing EV models in India.

While there is a vision for 100% electric vehicles by 2030, most industry experts indicate

that around 40-45% EV conversion by 2030 is a realistic expectation. A major push towards EVs will be led by the public transportation requirements in India – fleet cars, e-buses, 3 wheelers and 2 wheelers. Personal vehicle options for EVs will still be a relatively smaller element in the whole pie.

The NEMMP 2020 was extensively handled by the Department of Heavy Industries till 2016. In 2017, a major inter-ministerial discussion on this took place which included the Prime Minister’s Office, Niti Ayog (Planning Body), Department of Heavy Industries, Power Ministry, Ministry of Surface Transport & Roads, Urban Development Ministry, Petroleum and the Finance Ministry.

From this emerged a need to look at transforming the mobility in the country, reduce the dependence on fossil fuels and curtail import obligations. One of the key pillars of this transformative mobility is the emergence of EVs and the EV infrastructure that is likely to be needed. Post this discussion, the Niti Ayog has come out with a report on the plans for the

Government on Transformative Mobility Solutions for All.

Electric car market at a very nascent stage with only one serious player which was a year back is same as today

About 7100 cars on road since the introduction of the first electric car in 2001 by REVA (Mahindra). Mahindra has a manufacturing facility in Bengaluru and planning one in Nashik.

About 80 charging locations across 10 cities with ~86% located in Delhi, Kolkata, Bengaluru and Pune may come up. Free charging service as of now and will cost around ₹60–66 per charge in the future.

Limited support from the government in the car market. Currently, the market is limited to only Delhi and Bengaluru. For 2W, since 2012, there were no fiscal incentives available for EVs and sales slumped to 20,000units. Now with the FAME policy, sales have started to rise but most of the earlier EV 2-Wheeler firms have shut shop. The government subsequently slashed the import duty on batteries from 26% to 4%.

Tata Motors launched their EV Passenger cars business by winning a major tender of 10,000 cars launched by EESL. They have launched a car – Tigor EV and have recently delivered their first set of cars to EESL from their Sanand Plant in Gujarat. The Tigor Electric will be able to do about 120-150 kilometres on a full battery charge.

Tata Motors is also setting up 400 charging stations in Delhi alone and has plans for more cities.

They plan to develop their own vendor for chargers as well.

Renault plans to make India a hub for electric vehicle components. Rico Auto Industries Limited got the orders for manufacturing electric motors and transmission parts for Renault’s electric vehicles through a global tender process. Later this year, it will launch the electric variant of its small car Kwid in China; plans to bring the electric version of Kwid in India as well.

Mahindra & Mahindra – Mahindra & Mahindra (M&M) plans to produce 48,000 electric vehicles (EV) by 2021-22; to invest ₹400 crores in Karnataka and ₹500 crores in Maharashtra for making EV components.

Maruti Suzuki will start making its first affordable electric vehicle (EV) by 2020 based on technology from parent Suzuki Motors, ahead of products developed in partnership with Toyota.

Hyundai Motors, India’s second-largest car maker, plans to launch its first electric car by 2019.

Create a Viable Model for Charging Infrastructure

Based on the NITI Ayog plan, the Ministry of Power has already undertaken several leads in pushing the EV Infrastructure initiatives though various PSU companies:

• National Thermal Power Corporation (NTPC) – plans for setting up 100,000 EV charging stations in India

• Bharat Heavy Electricals Limited (power equipment PSU) plans to make batteries in India using the lithium technology developed by ISRO.

• Energy Efficiency Services Limited (EESL – a national ESCO company, experienced in large tendering process) has already issued tenders to source 10,000 EV and about 4,000 EV chargers in India.

• Rajasthan Electronics (I) Limited, (REIL) – plans to set up 200 charging stations in Delhi, Jaipur and Chandigarh, Fortum India, Finland’s utility firm, and TATA projects plans to enter and set up nationwide EV Charging stations.

EV charger industry in India

The Government of India recently notified the Protocol for Adaption of Standards for Bharat Chargers (AC-001 & DC-001).~15 firms currently supplying EV Chargers in India. Only three firms in 4W, AC Chargers so far in India.ABB India, Bosch, Delta India, Schneider India, Siemens India are looking at the Indian market closely.

These firms

EV charger industry in India

The Government of India notified the Protocol for Adaption of Standards for Bharat Chargers (AC-001 & DC-001). ~15 firms currently supplying EV Chargers in India. Only three firms in 4W, AC Chargers so far in India. ABB India, Bosch, Delta India, Schneider India, Siemens India are looking at the Indian market closely. These firms have their global designs and products and are studying the technical specifications, business models and potential for their products.

Lithium Ion Battery Packaging Started Seriously In India Over the Last One Year

Lithium ion cell manufacturing is still not on the radar even though the government is seriously contemplating this and attracting investors. As of last year, most Lithium batteries were being imported from China, South Korea, Vietnam, Singapore and Japan predominantly.

The lithium ion battery packaging capacity in India is ~500MWh in FY 2017-18 and was likely to reach 1GWH by the end of 2019.

IN NEWS(SOURCE THE MINT 12-01-2021)

Elon Musk’s Tesla opens India entity in Bengaluru, names three directors

- Tesla has named Vaibhav Taneja, Venkatrangam Sreeram and David Jon Feinstein as the three directors in the newly formed entity in the country

- The state government had earlier said that Tesla would open an R&D centre in Bengaluru

Billionaire Elon Musk-led Tesla has registered a subsidiary company in India, as the Cupertino-headquartered electric vehicle (EV) maker eyes a slice of the largely untapped domestic sustainable automobile market.

According to a Registrar of Companies (RoC) filing, the new entity Tesla India Motors and Energy Private Limited is registered in Bengaluru, Karnataka and is classified as a subsidiary of a foreign company. It has also registered its office in Lavelle Road, a business district in the southern city, with paid-up capital of ₹1 lakh and an authorised capital of ₹15 lakh, according to the filing

The state government had earlier said that Tesla would open a research and development (R&D) centre in Bengaluru but that it had offered space for any other plans the company may have including a manufacturing plant.

Union road transport and highways minister Nitin Gadkari said in late December that Tesla will begin its operations in India early this year, with sales and then venture into assembly and manufacturing of electric cars.

Tesla did not respond to an email seeking more information.

Tesla’s likely entry into India comes at a time when the union and state governments have been encouraging higher adoption of green vehicle technologies to help bring down the carbon footprint.

Mobility startups like Ola, Uber, Bounce and Vogo among others have made targets to include more EVs into their respective fleets. Ola, the Bengaluru-headquartered company has also forayed into manufacturing as it has set up a two-million two-wheeler EV plant in Tamil Nadu at a cost of ₹2400 crore. Other big companies like Mahindra, Hero and Hyundai and startups like Ather are surging ahead with its respective plans to capture a higher share of India’s nascent EV market that accounts for less than 1% of the entire automobile market in the country.

Elon Musk, who recently became the wealthiest individual in the world overtaking Amazon Inc. founder Jeff Bezos, also enjoys a cult-figure like status in India as he does abroad which has added to the growing demand for Tesla and its products.